A new survey has found that a quarter of young tenants in South London admit to subletting their rented properties. The survey, conducted by Direct Line, found that the most common reason for subletting was to offset the cost of rent. Other reasons included wanting to make some extra money, having friends or family stay over, or needing to move out temporarily.

The survey also found that young tenants are more likely to sublet than older tenants. This is likely due to the fact that young people are more likely to be living in rented accommodation and are therefore more likely to be struggling to afford the rent.

Subletting is a risky practice, as it can lead to eviction, fines, and even legal action. Landlords have the right to evict tenants who sublet without their permission, and they can also sue tenants for any damages that are caused by the subletting. It is after all, a breach of the tenancy agreement. Despite the risks, the survey found that many young tenants are still willing to sublet their rented properties. This is likely due to the fact that subletting can be a way to make some extra money or to have more flexibility in their living arrangements.

If you are a young tenant in South London and you are considering subletting your rented property, you should carefully consider the risks involved. You should also make sure that you have the permission of your landlord before you sublet.

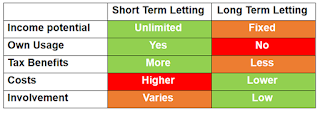

What does this mean for landlords? Well, some operate a "hear no evil, see no evil" policy, as long as the rent gets paid it's fine. But what if your tenant is subletting the whole property on a holiday let platform like AirBnB? This puts your lease at risk of forfeiture (if the lease prohibits commercial letting, or stipulates it must be used as a residential dwelling) or your mortgage company might call in the loan. After all, the property is being used for a purpose other than what they were lending you the money for. So it does come with risks, and no rewards for the landlord. It may also cause a nuisance to the neighbours, who will be all too keen to highlight to the local authority that the property is being let on a nightly basis for more than the 90 days which are allowed in any one calendar year. Short term guests can be a noise nuisance, and of course long term residents feel safer when they know their neighbours as opposed to when they do not.

So what to do? Well, a blind eye can be turned to speeding, little white lies and so on... as long as nobody gets hurt. Ultimately though someone will get hurt - a neighbour upset due to noise, the local council with you for flouting the law - it will catch up to you. So make sure that you are aware what is going on in your property by doing regular inspections! If you'd like further advice on letting, short or long - drop me a line and let's talk.

.jpg)